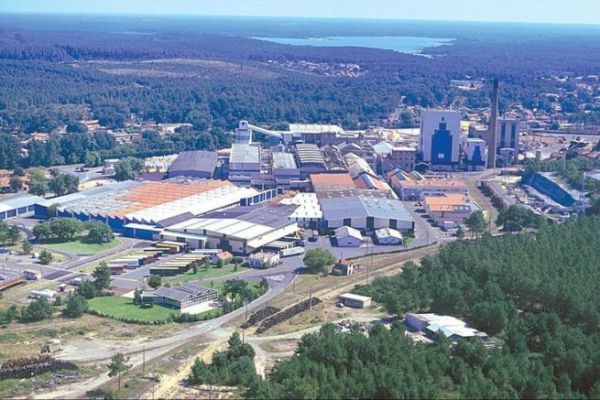

The Gascogne group recently completed a 20.9 million euro capital increase, approved by the Autorité des Marchés Financiers on November 13, 2024. This strategic financing is part of an overall investment of 21 million euros, designed to transform its Mimizan site, a nerve center for the production of unbleached kraft paper. By replacing three of the four existing machines with a new-generation unit, the Group hopes to boost productivity while reducing energy costs.

In addition to the purchase of the machine, this financing covers the construction of a dedicated building and an integrated logistics area to house the equipment required for cutting and packaging. These improvements are designed to better meet the requirements of the packaging market, while enhancing energy efficiency and environmental performance. Ultimately, this modernization should improve the site's carbon footprint, an essential criterion in a sector undergoing ecological transition.

The operation resulted in the issue of 8.2 million new shares at a unit price of 2.54 euros, with a 10.25% discount. The main shareholder, Attis 2, played a key role by subscribing a large part of the issue, consolidating its position to 66.64% of the capital. This consolidation also made it possible to transform a 10 million euro advance into capital.

With commissioning of the new machine scheduled for 2026, Gascogne expects a significant improvement in EBITDA from 2027. The company's strategy is based on optimizing production capacity and moving upmarket in its products. This investment should also boost the Group's competitiveness in packaging markets, where sustainability requirements are increasingly stringent.