Shein does not print books, nor does it become a publisher. But the entry into the American book market of this Chinese fast-fashion giant deserves a close look, especially for players in the graphic arts chain accustomed to the effects caused by major online platforms on their markets.

A textile player that captures the buying act

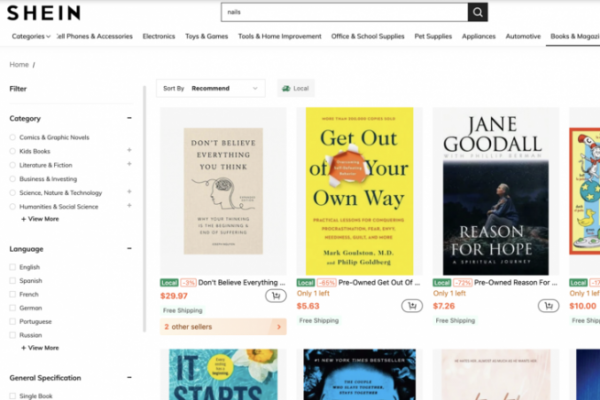

Shein adds a book category to a marketplace already geared to volume, low prices and rapid reference turnover. The U.S. partnership with the online network of independent bookstores Alibris is based on a familiar model: the aggregation of sellers offering their own items, new and used. The Alibris storefront on Shein provides access to 100,000 references, a number that Shein expects to grow.

New books, the real issue for printers

The Alibris offer includes both new and used books. For the graphic arts chain, the key point is new books, because they are part of the traditional manufacturing circuits of paper, printing and finishing. By making these titles accessible from a platform with a large audience, Shein adds an additional sales channel, likely to weigh on the distribution of new books, depending on visibility and order dynamics.

Used books: a segment to watch for the carry-over effect

The used part is based on copies already produced, so it doesn't trigger paper orders or new print runs, whether offset or digital. On the other hand, it can influence demand for new products through carry-over effects. The launch also highlights textbooks, a segment where the trade-off between new and second-hand is particularly sensitive in the United States.

Used books: a market without printing, but not without consequences

Used books generate neither paper orders nor offset or digital printing. In the medium term, the question is one of delayed consumption. A used textbook is a new, unprinted textbook. In the United States, where textbooks fetch high prices, this segment carries a lot of weight. The rise of generalist platforms is accentuating an already established trend.

Alibris, a discreet but structuring intermediary

Alibris is not a newcomer. Founded in 1998, the platform boasts a catalog of 200 million titles, new and used. Alibris already works with retailers such as Barnes and Noble and Waterstones. Its integration into Shein does not change its logistical flows or its relationships with sellers, but it does greatly expand the shop window. For book professionals, it's a reminder that value often shifts to the interface rather than the stock.

Where does the competition come in when books are sold through a marketplace?

The Alibris online offering is based on a very broad catalog, with new and used books. In this type of environment, titles can be compared in just a few clicks. For publishers and manufacturers, the question of why to buy one copy rather than another comes to the surface, and this is where differentiation makes sense.

One to three books a month, what Shein says about his customers

"The average Shein customer reads one to three books a month‚euros; it's not a fad, it's a way of life." says George Chang, Managing Director and Head of Shein Marketplace US. And according to a survey of 11,000 American adults conducted by the platform, a third of respondents said they read books daily or weekly, with a marked attraction for paper books. Romance, fantasy and detective novels top the list. This renewed interest is real, but here it will mainly benefit the circulation of existing copies.

For the printing industry, the signal is ambiguous: the book object is still desired, but not necessarily bought new.

What lessons for printers and publishers‚euros?

The Shein Alibris partnership will not change the graphics industry in the short term. It does, however, illustrate a gradual shift in power towards platforms capable of aggregating supply and capturing attention.

For print book professionals, the question has shifted: the sensitive point is not manufacturing, but capturing the end customer through the sales interface. And in this context, differentiation is once again a central issue, with the emphasis on publishing and manufacturing choices, and control of the entire chain, from file to reader. A subject that goes far beyond the American market alone.