Swiss carmaker Bobst is expected to leave the Zurich stock exchange within a few weeks. JBF Finance, which is owned by the Bobst family, published its prospectus on Monday for a public offer to acquire all publicly held shares of Bobst.

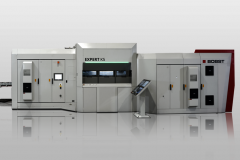

JBF Finance is the main shareholder of the manufacturer of printing and converting machines for labels and packaging, and is owned by about 60 descendants of Joseph Bobst who founded the group in 1890 and already holds about 53% of the company's shares and voting rights.

The takeover bid published by JBF Finance on July 25 is CHF 78 per share, "an attractive price" this represents a 22% premium to the average price in the four weeks prior to the announcement.

Following the completion of this offer, the shares of Bobst will be delisted from the Swiss stock exchange, Six Swiss Exchange.

By taking the group private, the Swiss manufacturer of printing and packaging converting equipment "focus on long-term, sustainable growth" . "This offer will provide the company with the right conditions to deploy a long-term strategy, complete its digital transformation and maintain its important industrial activities in Switzerland."

JBF Finance assures that Bobst will continue to be managed by "independent directors and family directors" .

The operation is expected to be executed around November 4, 2022.